At Silverstream, we can clearly see that now is a great time for home buyers to take advantage of the market’s lower property prices, but we can also understand the concerns that come with buying in a market downturn, especially when interest rates have risen. But in spite of this, economists are all reporting the same trends: the bottom of the market is now and interest rates are near their peak, which makes it a great time to buy a home.

So we’re going to let the stats do the talking! Here are 5 of the latest market statistics that show why now is actually a great time for you to buy a home:

1. Canterbury property prices are at a market low point.

Since the peak in November 2021, Canterbury property prices dropped around 11%, representing savings of tens of thousands of dollars for buyers. However, economic analysts are now all reporting the same trend—the bottom of the market has been and gone. The August edition of the REINZ Property Price Index shows Canterbury property prices have seen a slight increase in the past month and economists and banks are now predicting national property price increases in 2024 to lie somewhere between 3-10%.

So, what does that mean for you? It means that it’s possible to save tens of thousands of dollars if you buy while property prices have dipped. Remember—the general long-term trend for property is upwards, so the best time to start your property-buying journey to take advantage of these lower prices is today. Don’t quite know where to start? Check out our handy resource about Demystifying the Process here.

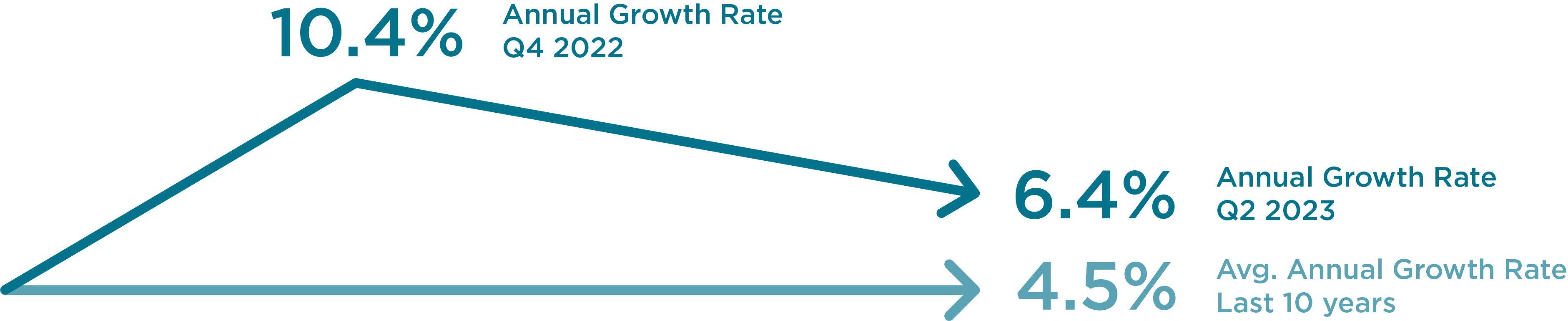

2. Interest rates are close to their peak.

While you may be watching nervously as interest rates have shot upwards, the Official Cash Rate has remained stable for two months in a row. Economic analysts at Opes Partners, are forecasting that interest rates are now very near their peak and will slowly fall over the next three years.

What does this mean for you? You can now have more certainty around calculating your mortgage repayments—and if you’re worried that this looks high, remember that this rate is likely to come down again over the next several years, easing your repayments. But if you’re considering waiting for interest rates to drop again, you’ll be trading off taking advantage of the low property prices. We recommend having a chat to your preferred mortgage advisers about what different purchase price and interest rate scenarios could look like for you.

*The predicted interest rates from Opes Partners are just an estimate. The exact numbers will be different.

3. There are more properties available for sale.

Compared to the peak in 2021, there are 72% more properties available on the market.

What does this mean for you? The property market is in the buyer’s court. This means you have more time to get to know your preferred areas, visit show homes, and find the right builder and design plan for your dream home. At Silverstream, we welcome you to have a chat with our developers directly about your home-buying journey—absolutely no strings attached!

4. First home buyers are the majority share of all property purchases.

First home buyers currently make up the largest share of property purchases, showcasing that buying during the downturn of the property market has remained favourable for those buying their first home. First home buyers are currently paying less for their homes than they were this time last year.

What does this mean for you? If you’re a first home buyer and feel like you’ve been pushed out of the market you may be surprised to learn that there are multiple schemes and incentives available, making it possible to purchase your first home—even with a deposit of less than 20%. If you would like to learn more about these incentives, have a read of our First Home Buyers Guide, or get in touch with a mortgage advisor.

5. Building costs are stabilising.

Building your own home is a really rewarding journey, but building costs rose in 2021/2022 due to the high demand for materials. The good news is that CoreLogic has reported that construction costs are stabilising, with supply chains running smoothly again and the industry is even seeing price reductions.

What this means for you: If you’re looking to build, you can take on a fixed-price contract with your builder, giving you confidence in the pricing and supply of materials for your home build.

We believe now is a great time to buy a home: property prices are at a market low point and interest rates are at their peak, with economists predicting rates to come down over the next few years. Additionally, with more homes on the market, there is plenty of choice out there. And if you’re thinking of building, construction costs are stabilising, giving you more peace of mind.

We welcome anyone who is on their home-buying journey to come and have a cuppa and a chat with one of our friendly Silverstream developers—no strings attached! We’d love to get to know you and help with any challenges you might be facing.